Most people have never thought about what will happen to their bitcoin, ether, and other crypto-assets if something bad happens to them. Even if you do understand the concept of passing your crypto-assets to your loved ones, actually doing the work to make it happen is often a daunting prospect. It’s one of those tasks, without a hard deadline, that gets pushed to the end of your to-do list, repeatedly. Most people don’t know where to start and there are very few resources available to help guide you through the process. But it doesn’t have to be that way.

You might not know this but we help people build crypto-focused estate plans both from the tech side (which wallets should I use?, where and how should I back up keys?, etc.) and the legal side (how can I make sure my step-child or domestic partner can inherit these assets?). Complex assets and family situations usually require help from experts, but no matter what your situation is, you can start planning today. Below is a template that some of our clients customize to let their loved ones know how to access these assets. You can use it, too. It’s a good way to get you thinking about the practical aspects of how your bitcoin, ether, classic, z-cash, monero, and other cryptocurrencies could pass to your heirs.

Using the Template

To use the template search for {} and fill in the blanks. It really is a template and will require significant customization to be useful by your heirs; be sure to delete sentences that don’t apply to your situation and make other changes as necessary. It’s most important to explain the kinds of assets, key locations, and access controls you’re using for security. Access controls are things like PINs, passphrases, multisignature or timelock requirements.

Avoid stating values in terms of local currency (e.g. US dollars), as the value will change by the time anyone reads the letter and that could cause confusion and conflict among heirs because they will expect the valuation in the letter to be correct.

Also avoid stating exact numbers of assets (e.g. 12.08975632 bitcoin) as these numbers will likely change too. The exception, of course, is long-term storage, as these amounts shouldn’t change too often and you can develop a habit that every time you modify your long-term storage you also edit your letter.

Letter Logistics

Ideally, you’ll print your letter on old-fashioned paper and store it with your will or trust, in a safe. You should only store the editable version of this document on digital storage that is secure, such as an external encrypted drive. Keeping this document online and unencrypted may provide a hacker, computer-repair tech, or anyone with access to your computer systems with a roadmap to find and steal your assets.

Steps to use the letter:

- Copy this letter into an editor

- Modify it to your needs

- Print it out (consider printing more than one copy)

- Store the paper copy in a secure location (or multiple secure locations)

- Copy the digital copy from your computer to a secure digital location, or encrypt it.

- Securely delete the unencrypted local copy from your computer (search for “secure delete” to find out how)

If you do not know how to do the above or don’t feel comfortable doing it on your own, hire an expert or simply hand write your letter on a single sheet of paper.

Additional Legal Documentation Required

Please be aware that this letter alone won’t be enough to ensure the assets are passed to the people or charities you choose. For that you’ll need a legal will or trust, conforming with the local laws where you live. If you want to learn more about local laws, you can start with the search terms “probate,” “intestate,” “executor,” or “holographic will” and your local city, county or town name. But don’t wait until you know local laws to use this template. It shouldn’t be an all-or-nothing thing. Your heirs need you to do this now, so don’t wait.

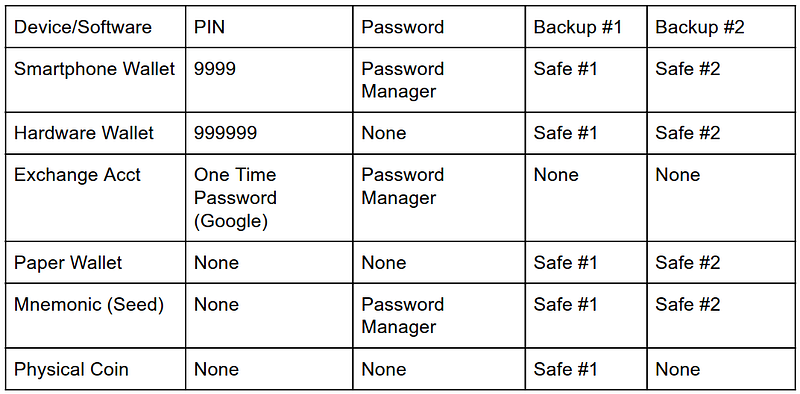

Access Control Table or Narrative

If you have many devices or wallets it might make more sense to use a table to provide your login information, like the one below. Alternatively, if you have only a few access points and/or your family is not very tech savvy, you could write a narrative to guide them through the process as illustrated in the letter below.

Template: Letter to Loved Ones

Template Start

Dear {friends, family, estate},

Today’s date is {insert date}. This letter is to inform you that I own digital assets that aren’t held or controlled by third parties. I want to be sure that you can access them in case someday I can’t. Please read through this letter completely before you take any action and contact Empowered Law (empoweredlaw.com) before you start moving funds. I built my plan with them and they can help you learn how to handle these assets securely. In case they’re not available, you can also contact ___________________ or _______________________. Do not access them unless {death, mentally injured, _______________________}.

Remember, these assets aren’t held by a bank and mistakes can’t be fixed; the transfers must be done correctly or the funds could be lost forever. Closely watch everyone who helps and make sure you understand everything that is happening. Be extremely careful with “wallet backups” because anyone who sees them can steal the assets.

I use PolyGox {list exchanges} to trade cryptocurrencies and assets. There may be cash or assets held there now. You should move these assets out of the exchange as quickly as possible because the exchange is not insured and if the system is hacked the funds might disappear without recourse. In order to access this account you’ll need my username, password, and a security code. You’ll find my username and passwords stored in my password manager. ________________________ knows how to access my password manager or instructions to access my password manager can be found ________________________. You’ll also need my phone PIN (stored _______) and the PIN for my Authy app (stored __________). This account is connected to my bank account at ____________ and cash withdrawals should be deposited into that account and distributed in accordance with my will dated _____________. *Please note, in many jurisdictions only a court approved executor has the legal right to move or liquidate assets after death. Directing someone other than the executor to do this could create legal problems for that person even if they are simply following your wishes and have no malintent.

I use a Trezor hardware wallet to store keys for most of my bitcoin and ether holdings. You can access the bitcoin holdings using Trezor’s official wallet software. You can access the ether holdings by using MyEtherWallet software. To access the funds you’ll need the PIN (stored ______) and the device itself. If you can’t find the device or the PIN, you can also access the funds by using the wallet backup seed stored ___________ and using the “restore” function to put the keys onto another Trezor device or software wallet. If you need to use this restore functionality you’ll probably need help. Contact __________ for assistance.

I use the Jaxx application on my phone to store small amounts of bitcoin, ether, ether classic, and z-cash. In order to access these assets you’ll need my phone PIN (stored _______) and the PIN for my app (stored __________). If you can’t access my phone, my wallet backup seed is stored ___________. With the wallet backup, you can use a restore function to recreate this wallet on another device. If you need to do this you’ll probably need help. Contact ____________ for assistance.

I use Copay, a multisignature software application, to store most of my bitcoin holdings. These bitcoin are locked by more than one key and in order to disburse them you will need access to two of the three keys I used to lock the funds. The three keys used to lock the funds are (1) a Trezor hardware wallet using the Copay Chrome App on my laptop, (2) a Ledger hardware wallet using the Copay Chrome App on my desktop, (3) Copay wallet application on my phone. In order to use the Trezor keys you’ll need the Trezor device (stored __________) and PIN (stored _________). In order to use the Ledger keys, you’ll need the Ledger device (stored ______________) and PIN (stored _________). In order to use the keys on my phone you’ll need my phone PIN (stored __________). In order to access my desktop you’ll need my encryption password (stored ___________) and my user password (stored _____________). In order to access my laptop you’ll need my encryption password (stored _____________) and my user password (stored _______________). If you do not have access to at least two of the hardware wallet devices or cannot find the PINs, then you’ll need to use the wallet backup seeds which are stored separately. The Trezor wallet backup seed is stored ____________. The Ledger wallet backup is stored ________________. My Copay phone application wallet backup seed is stored __________________. With the wallet backups, you can use a restore function to access the bitcoin on another device. If you need to do this you’ll probably need help. Contact ____________ for assistance.

In order to liquidate these assets you’ll need to go through an exchange. It may be helpful to use _______ exchange, where I already have an account. In order to transfer these assets to others without liquidating them, each person must set up their own account to receive the assets. This is not something that can be done, in aggregate, by an executor, trustee, or third party for important security reasons. Contact Empowered Law or another professional, trusted organization for assistance.

This document is intended to supplement my will and allow these assets to pass either through the intestacy statutes or through a will or trust that has been previously set up. My current will is dated {insert date}________________ and stored {location}________________.

This letter was last updated on {insert today’s date}.

Signed: __________________________________

{your name}

Regardless of your situation, you won’t regret planning now and your loved ones will be thankful you did; it’s time well spent. We hope you’ve found this article and template useful. We’re always interested in your feedback, please share your thoughts with us. You can reach us directly through our contact form. If you want to do more complete planning, consider our book: Cryptoasset Inheritance Planning: A Simple Guide for Owners. Keep up with the latest in cryptoasset inheritance planning by signing up for our mailing list (no spam and we won’t sell your info).

This article and letter were first published by Pamela Morgan on June 7, 2017. This work is published a Creative Commons Attribution Share-Alike 4.0 International License.